加密货币海外代理公司:如何选择最适合您的业

近年来,加密货币市场的发展势头迅猛,吸引了越来越多的投资者、企业和创业者。在这个数字资产日益普及的时代,选择一个可靠的海外代理公司对于希望进军国际市场的企业至关重要。本文将详细介绍加密货币海外代理公司,包括如何选择适合的公司、市场的现状、主要挑战、以及相关的法律法规等内容。

一、加密货币市场现状

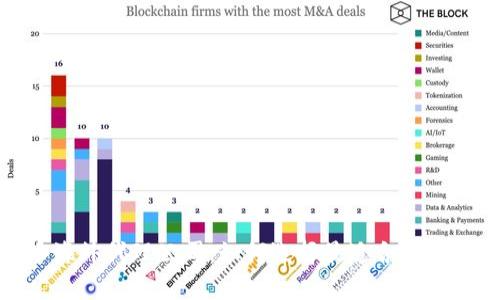

随着区块链技术的成熟和加密货币的普及,全球范围内的投资者和企业开始关注并参与这个新兴市场。尤其是在一些国家,政府对加密货币的法规逐渐放宽,不少企业选择将其业务拓展到海外市场。根据多个研究机构的数据显示,预计未来几年内,加密货币市场的市值将继续增长,更多的投资机会将随之涌现。

而加密货币海外代理公司正是帮助企业和个人进入这一市场的桥梁,通过提供专业的咨询、市场研究、合规支持等一系列服务来降低进入门槛。

二、选择海外代理公司的关键因素

在选择加密货币海外代理公司时,企业应关注以下几个关键因素:

1. 公司的信誉和口碑:信誉是选择合作伙伴的第一要素,企业可以通过网络搜索、查阅用户评价和行业报告来了解代理公司的市场声誉。

2. 专业知识和经验:加密货币和区块链技术的发展迅速,选择那些在该领域有丰富经验的公司至关重要。他们更能提供针对性的建议与解决方案。

3. 合规性:在选择海外代理时,确保他们能够帮助您遵循相关国家和地区的法律法规,以减少因合规问题可能带来的风险。

4. 服务范围:不同的代理公司提供的服务内容有所不同,企业需根据自身需求选择合适的服务,包括市场分析、投资顾问、技术支持等。

5. 客户支持:优质的客户服务是良好的合作基础,确保该代理公司能够即时响应问题与需求。

三、加密货币海外代理公司面临的挑战

尽管加密货币市场潜力巨大,但海外代理公司在提供服务时也面临一些挑战:

1. 法规环境复杂:各国对加密货币的法规制度差异很大,代理公司需要深入了解各国法律规定,以确保提供合规服务。

2. 市场波动性:加密货币市场波动剧烈,代理公司需要具备应对市场不确定性的能力,为客户提供合理的风险管理建议。

3. 安全风险:在处理加密资产的过程中,代理公司可能面临安全性挑战,包括网络攻击、资产被盗等,必须采取有效的安全措施。

4. 竞争的加剧:随着市场参与者的增多,代理公司需要不断创新与服务,以保持竞争力。

四、加密货币的投资机会与风险

对于希望通过加密货币投资获利的企业和个人来说,必须清楚地了解市场的投资机会及相应风险:

1. 投资机会:当前加密货币市场存在多种投资机会,包括主流的比特币、以太坊等数字货币的投资,以及DeFi、NFT等新兴领域的探索。

2. 出口机会:一些加密货币在特定地区或国家可能存在价格差异,这种差异为套利提供了机会。

3. 风险因素:投资加密货币风险极大,价格波动、市场流动性、法律合规风险等都可能对投资者造成重大影响。企业和个人应做好充分的市场调研和风险评估。

五、法律法规的影响

加密货币的快速发展引发各国政府的关注,相关法律法规的出台对代理公司的运营和投资策略产生重要影响:

1. 各国立法动态:例如,某些国家早已明确表示支持并推动加密货币的发展,而其他国家则采取谨慎姿态,甚至暂时封锁加密交易。

2. 反洗钱政策:许多国家要求提供与加密货币交易相关的严格的反洗钱(AML)和了解客户(KYC)程序。代理公司需要遵循这些要求以保证合规性。

3. 税收政策:各国在加密货币的税收上也展现出不同的态度,一些国家对加密货币收益征税,而另一些国家则比较宽松。了解这些政策能帮助企业合理规划投资策略。

六、未来展望

展望未来,加密货币市场将继续发展,预计会有更多的潜在商机与挑战出现。企业在选择加密货币海外代理公司时,需不断关注市场变化,并根据自身的业务需求与发展态势做出灵活调整。

此外,随着技术的不断演进,未来的加密货币市场将更注重于合规及透明度,这将使得代理公司在业务开展与市场推广时遭遇更多的外部压力,为客户提供服务时的合规审查将进一步加重。

在这充满机遇与挑战的市场中,选择一家值得信赖的海外代理公司,将是您成功投资和展开国际业务的关键。

七、常见问题解答

1. What makes a cryptocurrency overseas agency trustworthy?

To determine the trustworthiness of a cryptocurrency overseas agency, potential clients should consider several factors such as the agency's track record, client testimonials, and the qualifications of its team. A trustworthy agency will have a history of transparent operations and compliance with regulations. References from previous clients can provide insights into the agency's reliability and service quality.

2. How does the legal landscape for cryptocurrencies differ across countries?

The legal landscape for cryptocurrencies varies significantly across countries. Some countries actively promote crypto, offering favorable regulations, while others impose strict bans or high levels of compliance. Understanding these differences is essential for agencies and clients alike, as it affects how they operate and navigate market entry. Agencies should familiarize themselves with local laws to guide their international clients effectively.

3. What are the main risks involved in investing in cryptocurrencies?

Investing in cryptocurrencies carries inherent risks, including market volatility, potential loss of investment, regulatory changes, and security vulnerabilities. Investors often experience significant price fluctuations within short periods, making it crucial to have a risk management strategy in place. Also, the presence of scams and fraudulent schemes can pose additional risks to unknowing investors.

4. Why is compliance so important for cryptocurrency agencies?

Compliance is vital for cryptocurrency agencies as it helps ensure that they operate within the legal frameworks of the jurisdictions they engage with. As regulatory bodies become increasingly vigilant, maintaining compliance can protect agencies from legal repercussions and reputational damage. Furthermore, compliant agencies can enhance investor confidence and attract more clients who prioritize regulatory adherence in their investments.

5. How can investors mitigate the risks of cryptocurrency investment?

Investors can mitigate their risks by diversifying their portfolios, conducting thorough research before investments, and staying informed about market trends and regulatory changes. Utilizing reputable trading platforms and implementing risk management strategies, such as setting stop-loss orders, can also help protect investments. Engaging with financial advisors or agencies can provide additional insights and guidance in navigating the volatile cryptocurrency markets.

6. What should businesses consider when selecting a cryptocurrency agency for international expansion?

When selecting a cryptocurrency agency for international expansion, businesses should evaluate the agency's expertise in the target market, understanding of local regulations, and the specific services offered. Additionally, assessing their communication style and willingness to provide customized solutions that align with the business's goals is crucial. Building a strong partnership with an agency can significantly affect a company's success in navigating foreign markets effectively.